Military Pay Calculator 2020 After Taxes

Having a stable income with a perk that frees from tax is just one of the biggest benefits of working within the military. Categories Military Pay Chart Tags military compensation calculator 2020 military deployment pay calculator 2020 military drill pay calculator 2020 military pay calculator 2020 military pay calculator 2020 after taxes military pay calculator 2020 reserves military pay calculator 2020 with taxes military pay chart 2020 bah calculator military retirement pay calculator 2020 military retirement pay chart 2020 calculator.

Download Salary Arrears Calculator Excel Template Exceldatapro In 2021 Excel Templates Excel Salary

Categories Military Pay Chart Tags military compensation calculator 2020 military deployment pay calculator 2020 military drill pay calculator 2020 military pay calculator 2020 military pay calculator 2020 after taxes military pay calculator 2020 reserves military pay calculator 2020 with taxes military pay chart 2020 bah calculator.

Military pay calculator 2020 after taxes. Military Retirement Annual Tax Liability. And just like salaried civilians in the private sector youre not eligible for overtime pay. Keep in mind you wont be charged federal tax on your earnings if you earn that income in a combat zone or under other circumstances that make the income tax-exempt.

The calculator includes all Regular Military Compensation RMC including Base Pay BAH BAS and which portions that are taxable and tax-free. If you are a self-employed Veteran or military spouse use this calculator to determine your self-employment taxes. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Use the Military Pay Calculator to see your current past and proposed future military pay by rank location and branch of service. Why is this important. 1040EZ Tax Form Calculator.

Your monthly pay is. Military pay is subject to federal tax in ways that are defined by federal law. Learn how to quickly use the 2020 Military Pay Calculator to estimate your annual military compensation and benefits.

You may also qualify for additional special pay based on your duties such as hazard pay. Use the Military Pay Calculator to estimate military salary by rank location and the branch of service. However the 62 that you pay only applies to income up to the Social Security tax cap which for 2021 is 142800 up from 137700 in 2020.

Your regular pay is taxable in the same way that other income is taxed. RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is. Download military pay charts to PDF or JPG.

Basic pay rates are calculated monthly rather than weekly or bimonthly and are subject to taxes like civilian pay. However your monthly withholding is only an approximation of your tax liability. For now its just as important that you are able to quickly calculate.

Having a consistent paycheck with a perk that devoid of tax is among the greatest benefits of functioning within the military. Military Pay Calculator 2020 A military participant that offers on basic task as well as active duty is qualified to obtain an allowance services as well as advantages as set up by legislation. Containing only seven required inputs the 1040EZ is one of the quickest forms for military members and Veterans to calculate your tax.

Armed Forces Army Navy Air Force Marines Corps Space Force and Coast Guard and do not include Guard and Reserve Pay. Historic pay charts pay raises and estimated future pay charts. RMC Calculator - RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is common to all military personnel based on their pay grade years of service and family size.

The IRS website has a withholding calculator so you can estimate your monthly tax withholding. Knowing which pay is tax-free can help estimate income tax. Your years of service and your rank which generally corresponds with your military pay grade.

Each month all active-duty members of the military receive a complicated and hard to understand document called a Military Leave and Earnings Statement LES. That means that your net pay will be 42787 per year or 3566 per month. Other options to calculate your total pay include where you live and the number of dependents you have.

Understanding how to read this document is extremely important and I will show how to do that on another post. Regular Military Compensation RMC is defined as the sum of basic pay average basic allowance for housing basic allowance for subsistence and the federal income tax advantage that accrues because the allowances are not subject to federal income tax. For active duty military members the 2020 deferred Social Security taxes will be collected in 24 installments from your mid-month and end-of-month pay between January 1 and December 30 2021.

For reservists and guardsmen performing intermittent duty in 2021 the amount collected may not be the same every pay period. The powerful FederalPay Military Pay Calculator allows you to easily calculate yearly military compensation. Any income you earn above 142800 doesnt have Social Security taxes withheld from it.

Many military members and Veterans can use the 1040EZ tax form instead of the more complicated 1040 to calculate their taxes. Taxable and tax-free portions are separated for convenience. See compensation by month and annually.

Taxes On Your Military Bonus. Military Pay Chart 2021 After Taxes A military member that serves on basic obligation as well as active duty is qualified to receive an allowance solutions and advantages as organized by regulation. Army Navy Marines and Air Force 2021 Military Pay Chart.

Your average tax rate is 222 and your marginal tax rate is 361. It will still have Medicare taxes withheld though. Basic Pay and Subsistence Allowance BAS are calculated based on paygrade and your Housing Allowance BAH is determined by zip code and dependants.

Your tax liability depends on your total income including what you bring in outside of your military pension as well as your family situation and deductions or credits. Two main factors affect where you fall on the basic pay scale. Pay estimates reflect all 6 branches of the US.

The Military Pay Calculator is the perfect tool to help you figure out just how much you make as a US.

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

Military Pay Calculator Military Benefits

Validate Your Tsp Contact Information Or Risk Being Locked Out Katehorrell Start Online Business This Or That Questions How To Plan

7 Easy Payroll Remittance Form Sample Payroll Payroll Taxes Form

What Is Medical Disability Retirement For Military Members Overall The Military Retirement System Is Set U Disability Retirement Medical Retirement Disability

Jitendra Tax Consultants Is A Registered Tax Agent With Fta And Provide Tax Related Services Our Expert Team Gives Vat Reg Tax Consulting Tax Forms Income Tax

Pin On Cutting For Business Blog Resources

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Military Medical Retirement Pay Chart 2020 Va Disability Va Benefits Medical Retirement

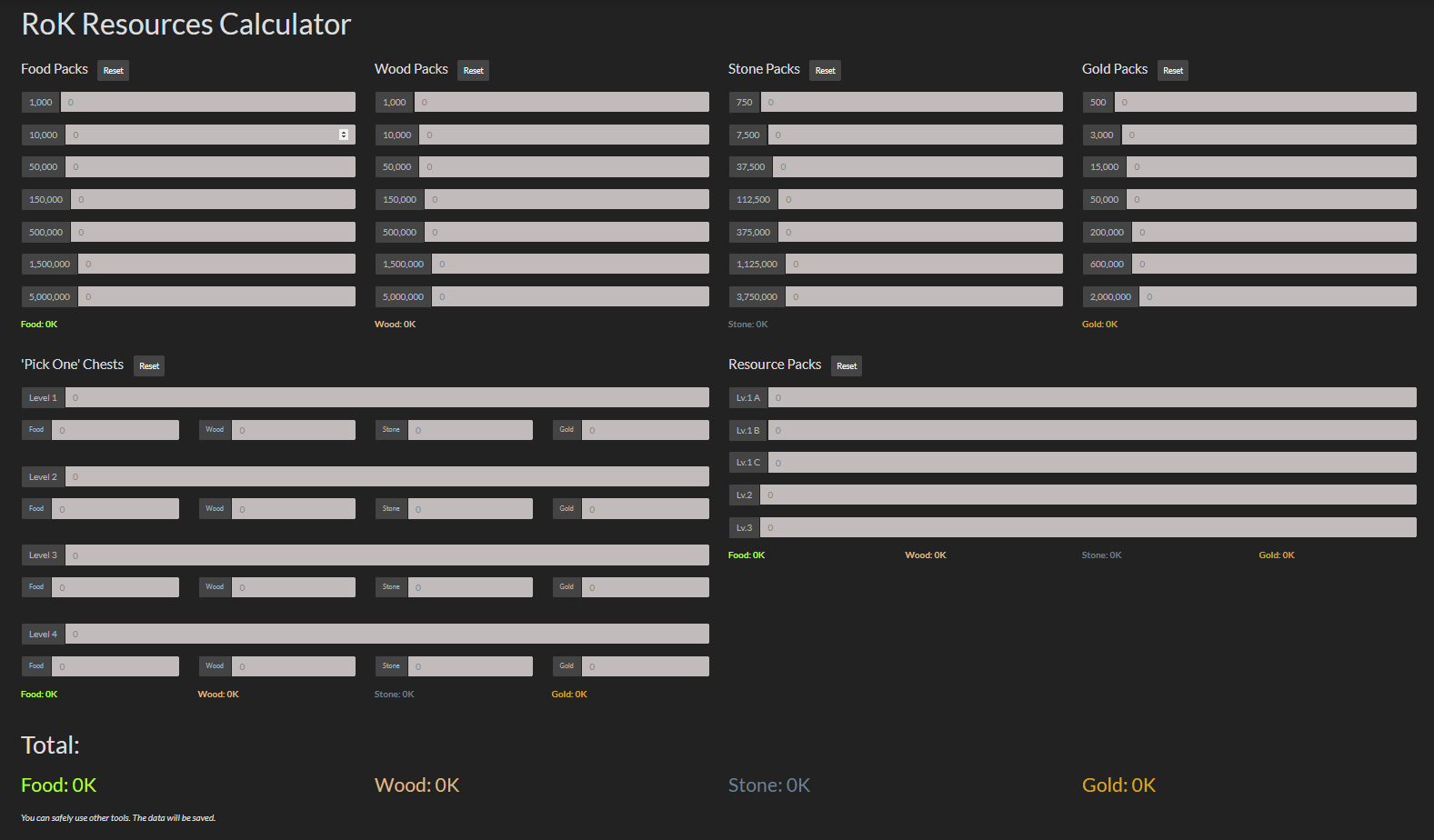

Rise Of Kingdoms Rok Online Calculator

Pin On Discover Politics Wake Up

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Tax Withholding For Pensions And Social Security Sensible Money

Post a Comment for "Military Pay Calculator 2020 After Taxes"